Getting My Thomas Insurance Advisors To Work

8 Simple Techniques For Thomas Insurance Advisors

Table of ContentsUnknown Facts About Thomas Insurance AdvisorsThe Thomas Insurance Advisors IdeasOur Thomas Insurance Advisors IdeasGetting The Thomas Insurance Advisors To WorkThomas Insurance Advisors - The Facts

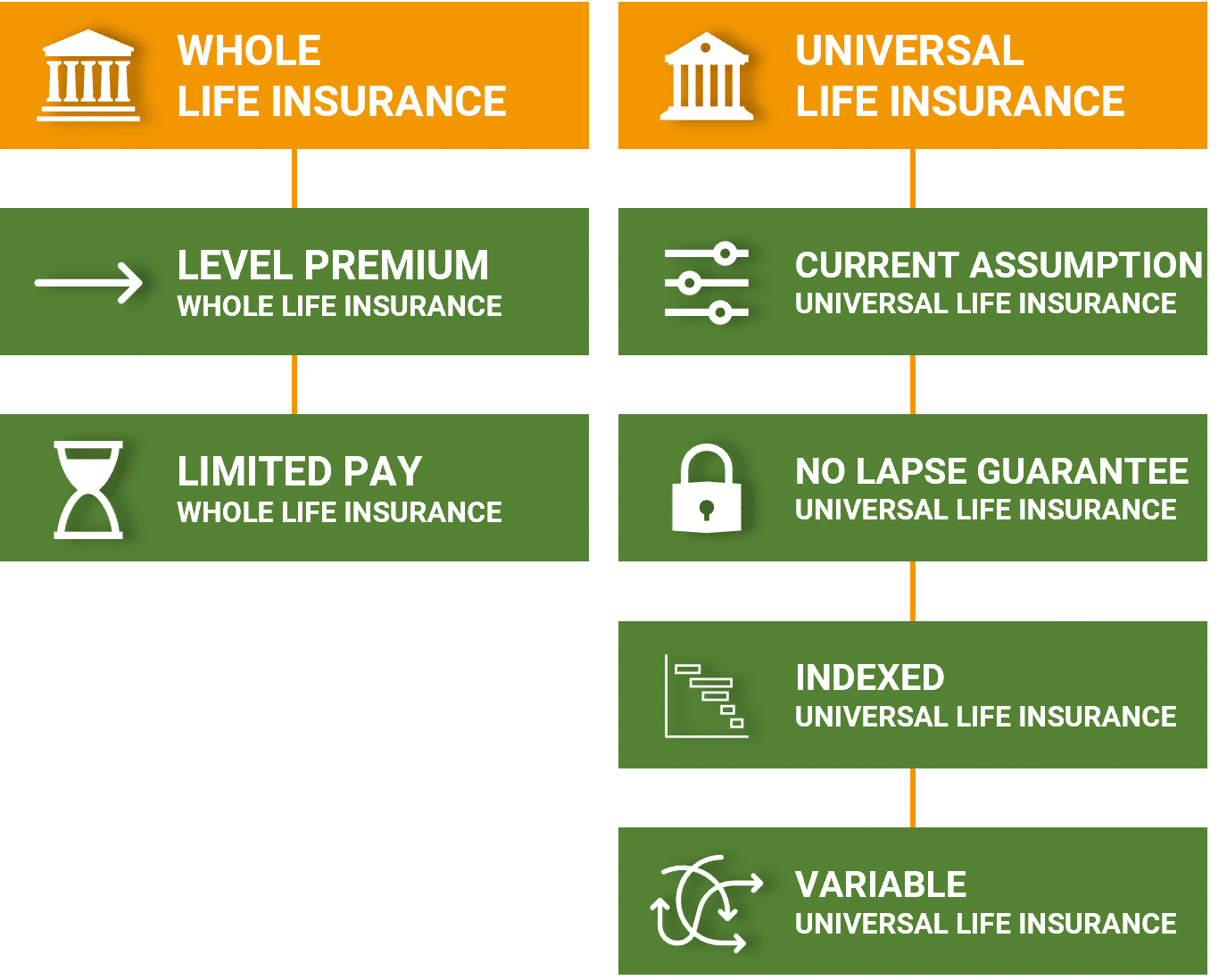

The cash value component makes whole life much more complicated than term life as a result of charges, tax obligations, rate of interest, as well as various other terms. Universal life insurance policy is an adaptable irreversible life insurance policy plan that allows you reduce or boost exactly how much you pay toward your month-to-month or yearly premiums with time. If you lower just how much you invest in premiums, the difference is withdrawn from your plan's money value.A global policy can be more pricey as well as challenging than a conventional whole life policy, particularly as you age and your costs boost (https://www.ted.com/profiles/44581492/about). Best for: High earners who are trying to develop a savings without entering a higher earnings bracket. Exactly how it functions: Universal life insurance policy permits you to adjust your costs as well as survivor benefit relying on your requirements.

The Thomas Insurance Advisors PDFs

Pro: Gains potential variable plans might make more rate of interest than conventional whole life., also recognized as interment insurance coverage, is a type of life insurance coverage developed to pay a small fatality benefit to your family to aid cover end-of-life costs.

Since of its high prices and lower insurance coverage amounts, last expenditure insurance coverage is generally not as good a worth as term life insurance policy. How it functions: Unlike the majority of conventional plans that call for a medical examination, you only need to answer a couple of inquiries to qualify for final cost insurance.

The 6-Minute Rule for Thomas Insurance Advisors

Pro: Guaranteed coverage simple accessibility to a little benefit to cover end-of-life expenditures, consisting of clinical expenses, funeral or cremation solutions, and also coffins or containers. Disadvantage: Expense costly costs for lower protection quantities. The very best method to pick the plan that's best for you is to chat with an economic advisor and work with an independent broker to find the best policy for your specific demands.

Term life insurance policies are generally the ideal remedy for people that need affordable life insurance for a specific duration in anchor their life (https://hearthis.at/jstinsurance1/set/thomas-insurance-advisors/). If your objective is to supply a safety web for your household if they needed to live without your earnings or payments to the household, term life is likely a good suitable for you.

If you're currently making best use of contributions to traditional tax-advantaged accounts like a 401(k) as well as Roth IRA and also want one more financial investment automobile, irreversible life insurance policy can function for you. Last expense insurance coverage can be an alternative for individuals that could not be able to get insured otherwise since of age or major wellness problems, or senior consumers that do not desire to problem their families with interment expenses.

Some Known Incorrect Statements About Thomas Insurance Advisors

Much of these life insurance coverage alternatives are subtypes of those included above, suggested to offer a particular objective, or they are specified by how their application procedure likewise called underwriting jobs - https://profile.ameba.jp/ameba/jstinsurance1. By kind of protection, By type of underwriting Group life insurance policy, also called team term life insurance, is one life insurance policy agreement that covers a group of people.

Team term life insurance is commonly subsidized by the insurance policy holder (e. g., your company), so you pay little or none of the plan's premiums. You get protection approximately a limit, normally $50,000 or one to 2 times your yearly salary. Group life insurance policy is affordable as well as simple to certify for, yet it rarely offers the level of insurance coverage you could require and you'll probably lose protection if you leave your task.

Best for: Anybody who's offered group life insurance coverage by their employer. Pro: Convenience group plans give assured insurance coverage at little or no expense to workers. Con: Limited coverage and also you normally lose coverage if you leave your employer. Home mortgage security insurance, likewise referred to as MPI, is developed to pay off your continuing to be home mortgage when you pass away.

Getting My Thomas Insurance Advisors To Work

With an MPI policy, the beneficiary is the home mortgage company or loan provider, as opposed to your family, and the survivor benefit reduces in time as you make mortgage settlements, comparable to a reducing term life insurance policy policy. Buying a standard term policy instead is a far better selection. Best for: Anybody with home mortgage obligations who's not qualified for typical life insurance coverage.

The policy is connected to a single debt, such as a mortgage or business lending.

You're guaranteed approval and also, as you pay for your finance, the survivor benefit of your policy decreases. Final Expense in Toccoa, GA. If you die while the policy is in pressure, your insurance coverage supplier pays the survivor benefit to your lending institution. Home mortgage security insurance coverage (MPI) is among the most usual kinds of credit score life insurance policy.